how to cheat a loan application

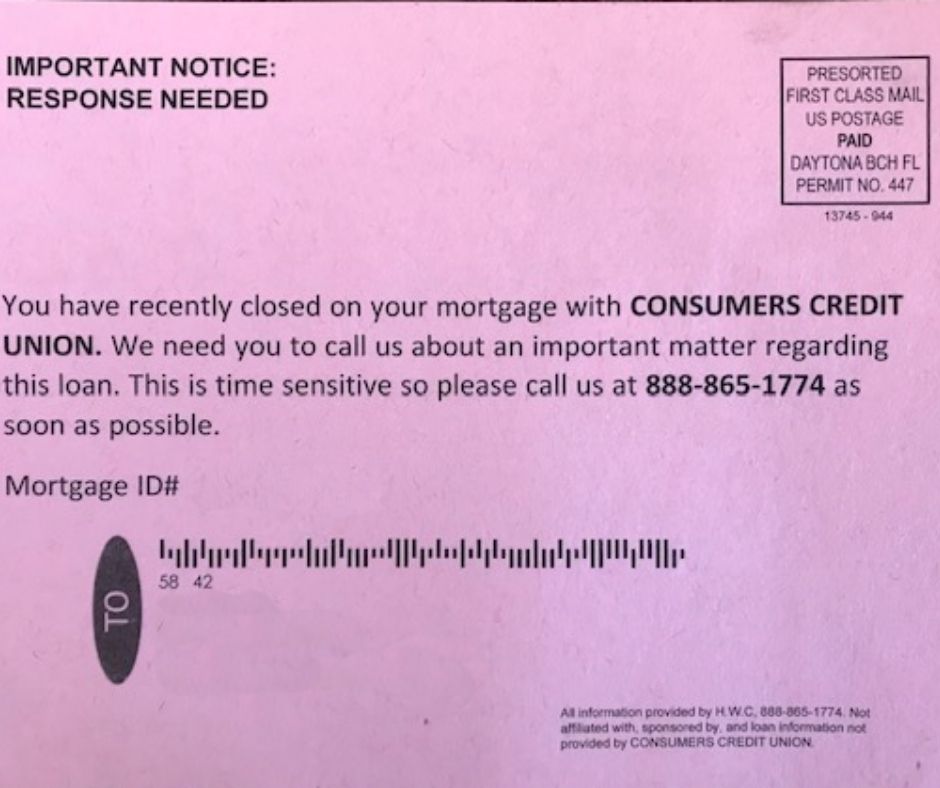

Be wary of offers asking for personal information such as Social Security, bank account, or credit card numbers. Most trustworthy companies will not solicit these details when first contacting them to find out if they would like to purchase mortgage insurance to protect you from the mortgage.