is there insurance that pays off mortgage

Mortgage Life Insurance is not a smart move for most people. Premiums tend to be significantly higher than level term insurance products. A decent, level-term policy (20 or 30-year term) will provide you with sufficient protection.

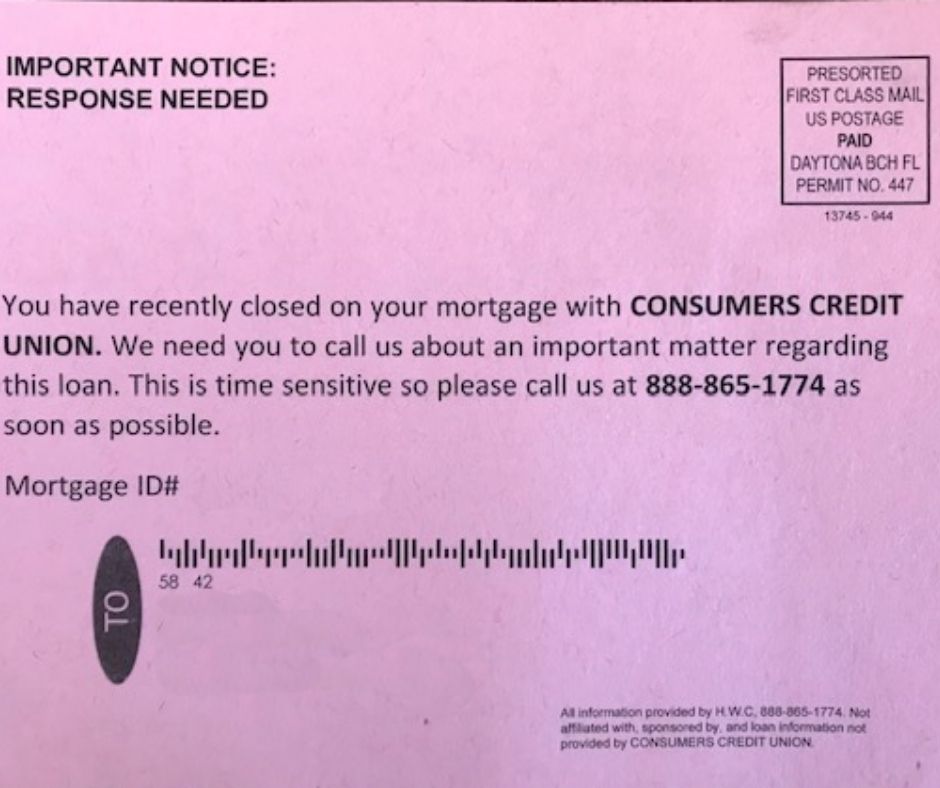

A few independent life insurance companies utilize these "life moments" to provide life insurance. They're not trying to fool you into believing they are part of your lender, but they want you to inform them of their offerings or services.