does mortgage insurance cover disability

Most companies offering medically-underwritten level life insurance offer three or four non-tobacco underwriting classifications, ranging from Standard to Preferred Best. If you're in excellent health, the cost of Preferred Best Non-tobacco is likely to be significantly lower than the Standard Non-tobacco. If you're a non-smoker, overweight, or taking medication for hypertension (for instance), you may qualify for the standard non-tobacco price.

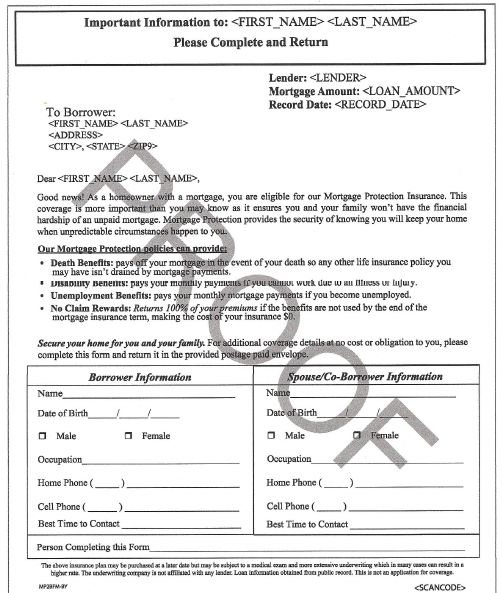

It may be surprising to find out who's recently bought a home that will be public. Information about who purchased or refinanced an existing home loan and the lender, the loan amount, and the address to which the loan is tied is available from the local courthouse. Businesses will contact new homeowners in the coming months with special offers such as life insurance and mortgage protection.