do you have to have mortgage protection insurance

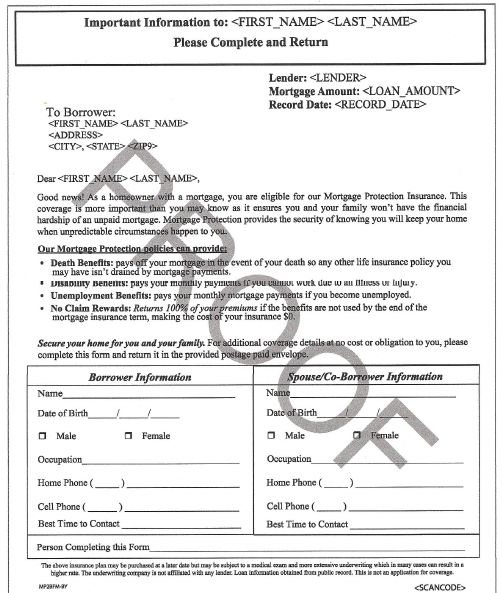

Life insurance for mortgages is specifically designed to make your mortgage payment upon loss of income or disabled. The policy typically has an increasing benefit (face) value that is reduced in proportion to the decrease in the value of your mortgage. The insured should name your spouse or a third party as the beneficiary so they can pay off your home in one lump amount. Your beneficiary could also keep the death benefit and continue to make monthly mortgage payments.